Consumers owed $11.83 trillion as of the end of 2014, according to the Household Debt and Credit Report produced by the Federal Reserve Bank of New York. Total debt increased by $306 billion during 2014, according to the report which is based on data from the New York Fed’s Consumer Credit Panel. This could potentially lead to more people filing … Read More

Fewer People Are Filing Bankruptcy in 2015

The American Bankruptcy Institute, using data provided by Equip Systems Inc., has reported that people are filing bankruptcy less and less. Bankruptcy filings decreased in February 2015 by 13 percent as compared to February 2014. Specifically, the number of consumers (individuals) filing bankruptcy decreased by 10 percent while the number of businesses filing bankruptcy decreased by 21 percent in this … Read More

Avoid Paying Insider Creditors Prior to Filing Bankruptcy

United States bankruptcy law identifies a category of persons known as “insiders.” Typically, an “insider” for bankruptcy purposes is a family member or a close personal friend to the person filing bankruptcy. In cases where a business is involved, an “insider” may also be a close business associate or partner. Persons potentially filing bankruptcy should avoid insider transactions which actually … Read More

Filing Bankruptcy with Tax Refunds

One of the biggest challenges facing debtors filing bankruptcy is coming up with the money to pay their filing and attorney fees. After all, if a person’s financial challenges are great enough to consider filing bankruptcy, the household budget is already pretty tight or in serious deficit. Most savings have already been exhausted by potential bankruptcy clients before they even … Read More

Chapter 13 Bankruptcy Cannot Modify Secured Debts on Mobile Homes

Changes in the law relating to titling of manufactured homes have recently been made in Missouri. This affects the way filing Chapter 13 bankruptcy alters or doesn’t alter your mobile home debt. 442.015.1 of the Missouri Revised Statutes now specifically state that “for the purpose of 11 U.S.C. § 1322 (b)(21), a manufactured home shall be deemed to be real … Read More

JP Morgan Chase to Pay $50 Million for Breaking Bankruptcy Law

According to the Consumer Bankruptcy News, the United States Trustee Program, which is affiliated with the U.S. Department of Justice, has entered into a national settlement agreement with JP Morgan Chase Bank N.A., requiring Chase to pay more than $50 million, including cash payments, mortgage loan credits, and loan forgiveness, to more than 25,000 homeowners who are or were filing … Read More

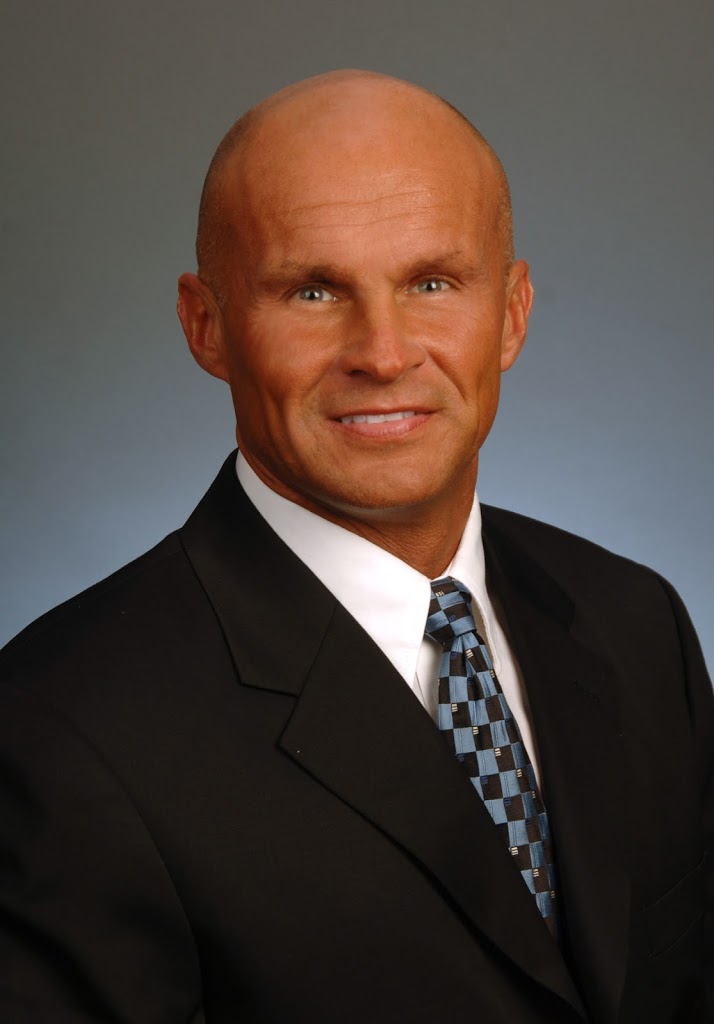

An Experienced RGG Law Attorney Fights for Client in Federal Appeal

Attorney Jon Gold of RGG Law appeared in Kansas City on February 25, 2015, before a three-judge panel of the United States Bankruptcy Appellate Panel (BAP) for the Eighth Circuit. He was representing an RGG Law client who was filing bankruptcy. While most bankruptcy cases do not involve contested matters or appeals to higher courts, those with more complicated financial … Read More

Chapter 13 Bankruptcy Filing Goes up in Smoke

A couple in Colorado who operate a marijuana business filed Chapter 13 bankruptcy proposing to pay their creditors with money earned through the sale of marijuana. While the state of Colorado has legalized the sale of marijuana it is still against Federal law. Because of this, the Bankruptcy Judge dismissed the couple’s case stating the Federal Bankruptcy Court cannot … Read More

Bankruptcy Lawyers Update: Changes in Mobile Home Titles

Changes in the law relating to titling of manufactured homes have recently been made in Missouri. These laws affect a mobile home owner’s potential bankruptcy claim. RGG Law bankruptcy lawyers explain. 442.015.1 of the Missouri Revised Statutes now specifically state that “for the purposes of 11 U.S.C. §1322 (b)(21), a manufactured home shall be deemed to be real property”. Under … Read More

Jon Gold Gives Presentation to Other Bankruptcy Lawyers

Want legal representation by the best of the best? Have the most experienced RGG Law attorney handle your legal matters. He mentors other bankruptcy lawyers from other firms in professional legal practice and ethical conduct. Jon Gold, a founding partner and attorney at RGG Law, gave a Bankruptcy Law Review and Update presentation to a group of bankruptcy lawyers at … Read More