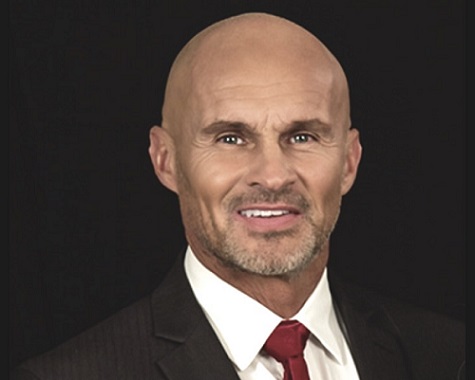

Attorney Jon Gold, one of the partners at RGG Law, recently completed a program of training pursuant to Missouri Supreme Court Rule 17 to become an official mediator of civil legal disputes in the areas of business law, employment law, real estate law and bankruptcy law. As a private attorney, he has courtroom experience with bankruptcy law and other civil … Read More

Bankruptcy Law Stipulates Domestic Obligations Stay Intact

In accordance with bankruptcy laws, child support obligations and alimony payments established in a state divorce decree are not dischargeable in a bankruptcy filing. The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) passed by Congress in 2005 has broadened the scope of divorce-related obligations that cannot be cancelled in the bankruptcy process. Specifically, these bankruptcy laws now refer broadly … Read More

RGG Law Tackles 5 Myths Concerning Bankruptcy Law

Bankruptcy is not something most people consider with eagerness. It is a last resort, to be sure, but the correct choice for many individuals and families needing a fresh financial start. Much of the fear surrounding bankruptcy is based upon myths and misconceptions about bankruptcy law. Below are five common bankruptcy myths that can be easily dismissed. Bankruptcy Law Myths … Read More

Filing Bankruptcy after Preferential Payments

Most people filing bankruptcy have certain obligations they would rather pay such as loans to family and friends before paying their other debts. But if a preferred creditor is paid back with money or property prior to filing bankruptcy it may be considered a preferential debt payment or transfer. The Bankruptcy Court has the power to undo the preferential payment … Read More

How Filing Bankruptcy Can Discharge Some Tax Debts

Ordinarily, tax debts are not discharged or cancelled after filing bankruptcy. There is a possible exception in regards to certain federal tax debts. Generally speaking, it is important to have all the facts about the specific debt before determining if Federal Income Tax is dischargeable. It’s also important to determine time periods which make tax debt dischargeable by filing bankruptcy. … Read More

Tips for Filing Bankruptcy: Beware of Credit Repair Scams

Those with challenging financial problems are often targeted by scam artists and fraudsters posing as legitimate credit repair companies or credit counseling organizations. Sometimes it’s important when deciding on filing bankruptcy to check your credit score. While there are legitimate groups out there who do actually help troubled debtors, you must be wary. Indeed, in a recent case the con … Read More

Filing Bankruptcy Without Full Disclosure

One of the bedrock requirements of bankruptcy law is that any debtor filing for relief must make a complete and accurate disclosure of their financial affairs at the time of filing bankruptcy. This applies both to information provided on the required schedules and documents filed in a bankruptcy case and to answers to questions asked by the trustee assigned to … Read More

Bankruptcy Law Buzzwords Defined

As with any area of law, bankruptcy law has its own buzzwords used by judges and lawyers that may not make sense to clients. While some bankruptcy law buzzwords may be easy to figure out, it does not hurt to have a cheat sheet. Bankruptcy Law Cheat Sheet 341 Meeting: Also known as a Trustee Meeting or Meeting of Creditors, … Read More

Credit Counseling Needed Before Filing Bankruptcy

In 2005, the United States Congress made significant amendments to the U.S. Bankruptcy Code with a new law called the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA). One of the many changes to the law was the addition of a credit counseling requirement for all persons filing bankruptcy, specifically Chapter 7 bankruptcy or Chapter 13 bankruptcy. The credit counseling … Read More

Filing Bankruptcy to Discharge Student Loans

Senator Tom Harkin (D-Iowa), Chairman of the Senate panel on education, will propose a bill to the U.S. Senate to allow some student loans to be dischargeable when filing bankruptcy. Currently, filing bankruptcy does not generally discharge student loan debt. Senator Harkin’s bill, as proposed, would allow private lender student loans to be discharged after filing bankruptcy. According to a … Read More